putnam county property tax rate

What is the Florida Property Tax Rate. Florida Property Tax Calendar Typical Year.

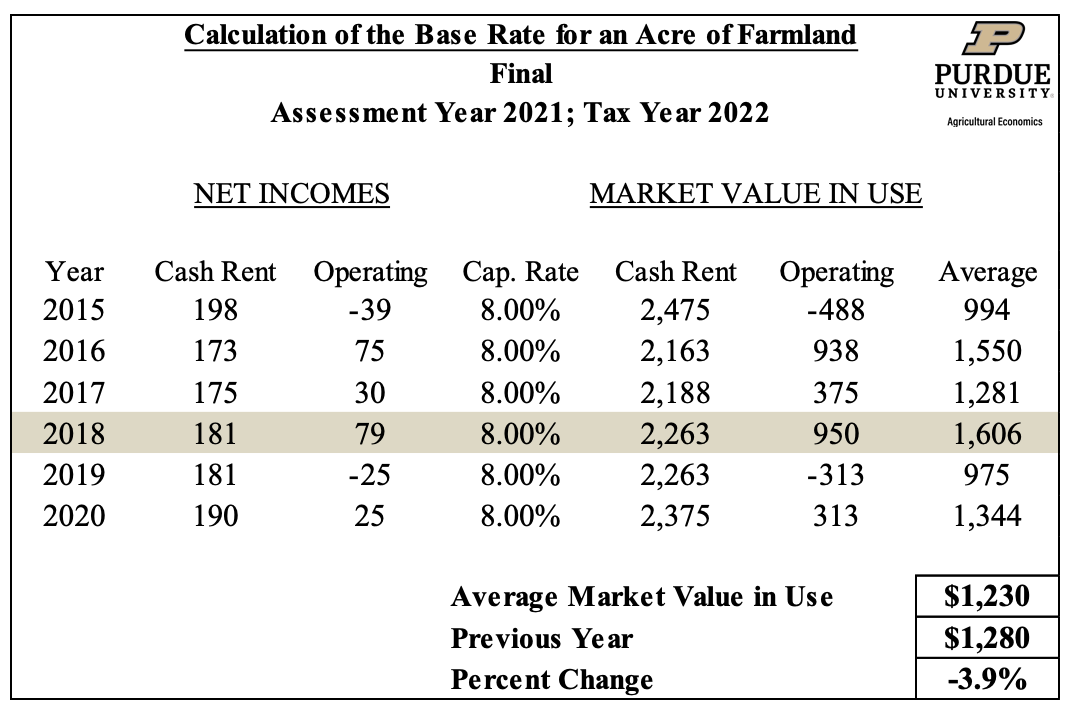

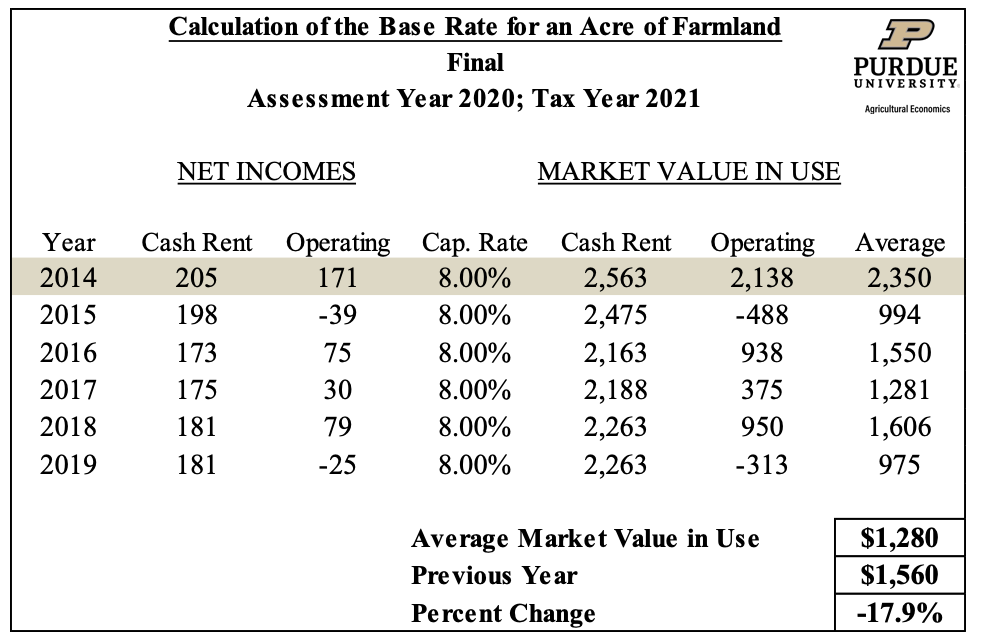

Farmland Assessments Tax Bills Purdue Agricultural Economics

Florida property tax due dates depend on the county within Florida.

. PDF 21 MB PT-111112. Putnam County Property Tax Search Randolph County Property Tax Search Ripley County Property Tax Search Rush County Property Tax Search. It was not possible to determine a countywide class-specific rate for Nassau County due to the complexity of taxing jurisdictions.

Where to go for State Tax Help. Ad Find property records tax records assets values and more. New York City and Nassau County have a 4-class property tax system.

Find All The Record Information You Need Here. These vary by county. Two Family Dwelling on a Platted Lot.

Start Your Homeowner Search Today. While the exact property tax rate you will pay for your properties is set by the. Gauging your property tax amount is.

Ad Get Record Information From 2022 About Any County Property. Georgia Property Tax Rates. 2019-2020 School Tax Rates Revised.

The median annual property tax payment in Jasper County is 899. The countys average effective tax rate is 078. The LOHE was in effect in Cook County beginning with the 2007 tax year for residential property occupied as a primary residence for a continuous period by a qualified taxpayer with a total household income of 100000 or less.

Ad Get In-Depth Property Tax Data In Minutes. Rates in Jasper County are likewise relatively low. 40 Gleneida Ave Room 104 Carmel NY 10512.

The property maps represented on this site are compiled from information maintained by your local county Assessors office and are a best-fit visualization of how all the properties in a county relate to one another. Thats about the national average. Total tax rate Property tax.

Real property refers to land buildings fixtures and all other improvements to the land. 2022-2023 School Tax Rate Sheet. Discover public property records and information on land house and tax online.

The statewide exemption is 2000 but it applies only to the statewide property tax which is a relatively small slice of the overall property taxes in most areas. Located in western Missouri the Cass County average effective property tax rate is 107. Ad valorem taxes are.

Residents of Marion County pay a flat county income tax of 162 on earned income in addition to the Indiana income tax and the Federal income tax. Ad Valorem and Non-Ad Valorem Calendar. Real Property Tax Service Agency Putnam County New York.

Two Family Dwelling on a Platted Lot. Nonresidents who work in Marion County pay a local income tax of 041 which is 121 lower than the local income tax paid by residents. Property taxes are levied annually on real property real estate and tangible personal property.

2021-2022 School Tax Rates. 196081 Veteran Permanent and Total Disability Exemption. Search Valuable Data On A Property.

PDF 324 KB PT-111111. Property taxes can be confusing. 2020-2021 School Tax Rates.

The PTELL is designed to limit the increases in property tax extensions total taxes billed for non-home rule. PDF 20 MB FAQ. Such As Deeds Liens Property Tax More.

Property tax rates in Georgia can be described in mills which are equal to 1 of taxes for every 1000 in assessed value. To access specific property tax programs services and information please use the Property Tax Services menu available on this page. Unsure Of The Value Of Your Property.

Your actual property tax burden will depend on the details and features of each individual property. Choose a search type. All responses are directed toward customer understanding and satisfaction of how NYS Real.

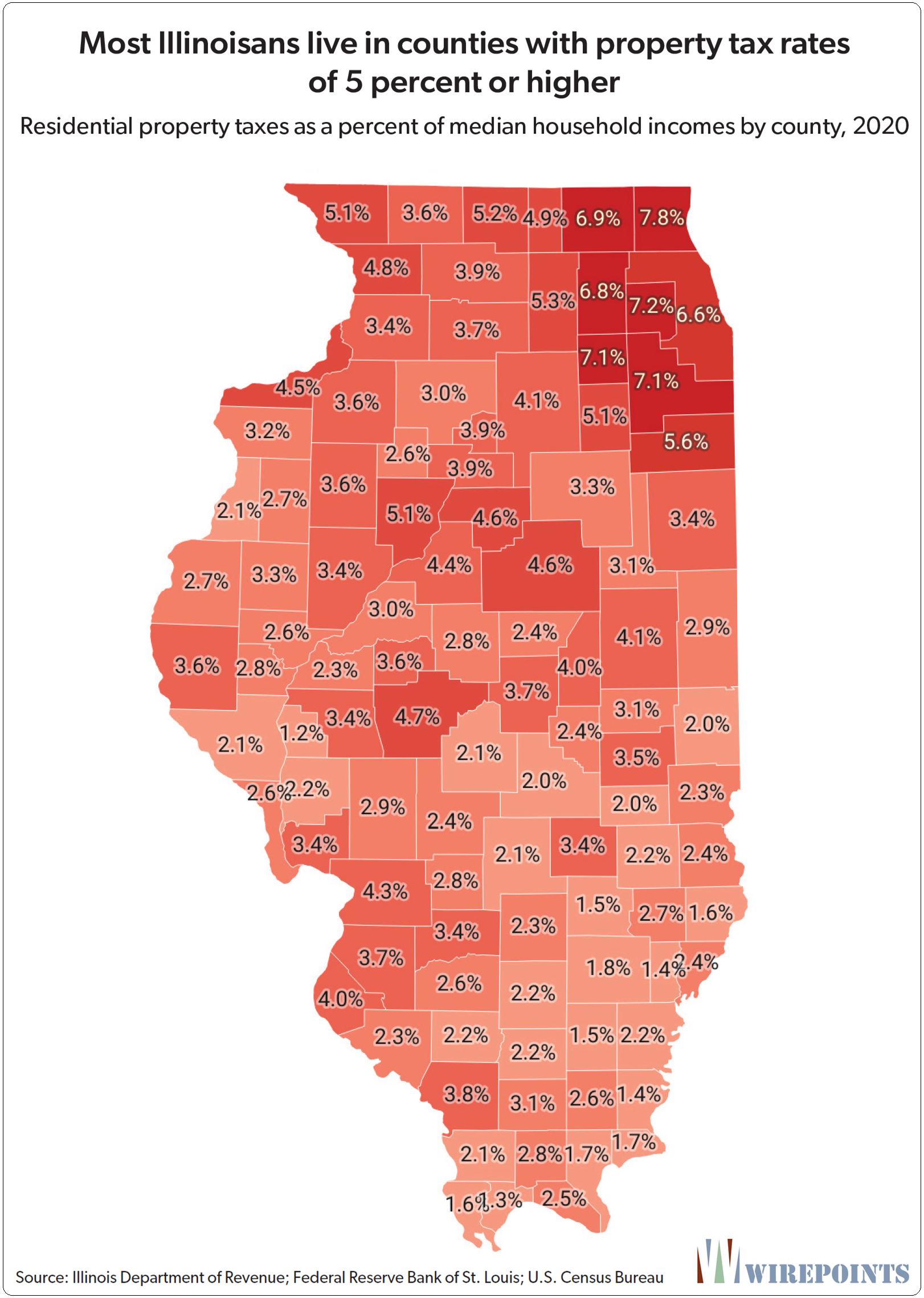

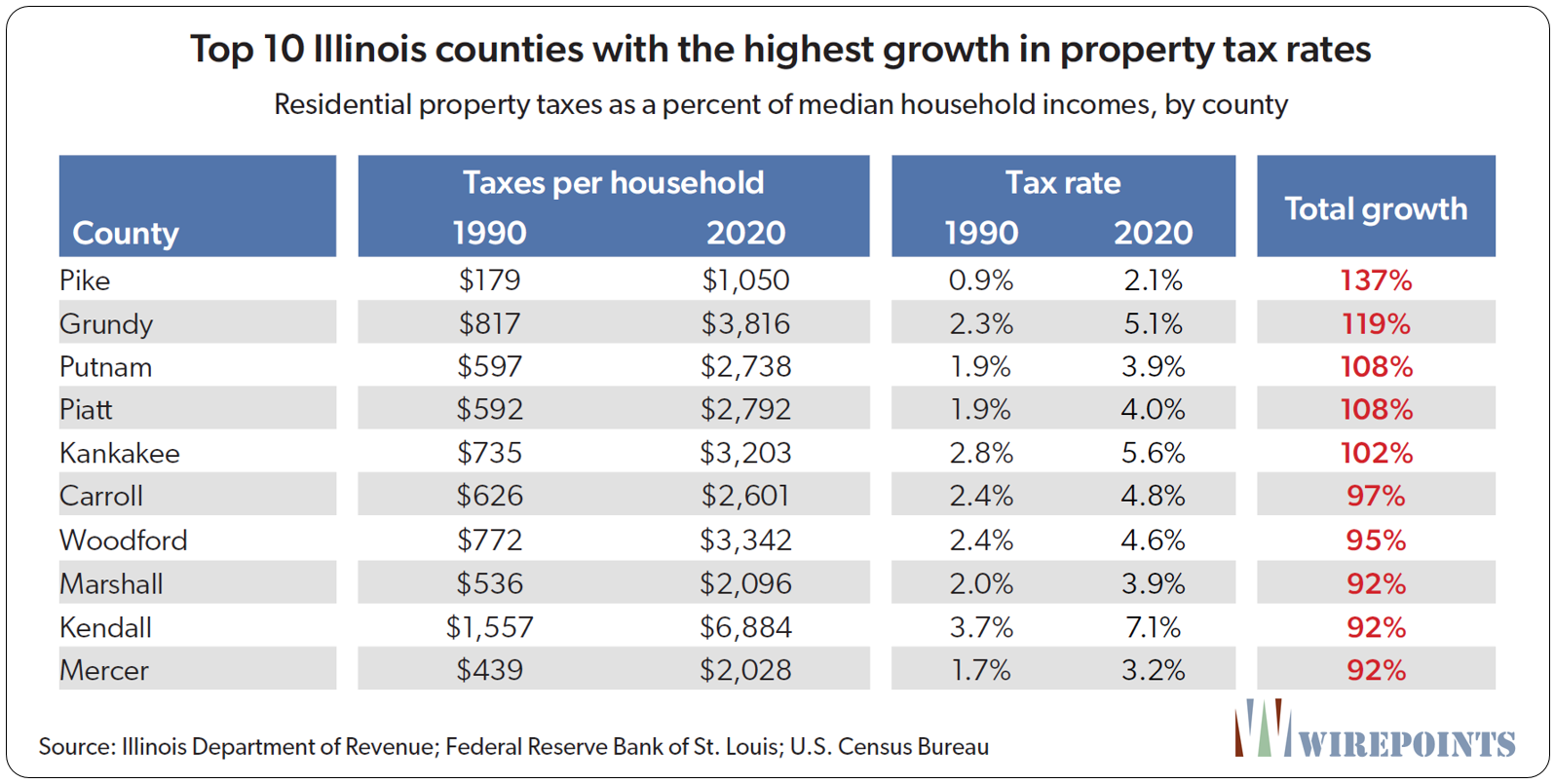

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

Proposed Property Tax Amendment Could Jeopardize Local Excess And Bond Levies West Virginia Center On Budget Policy

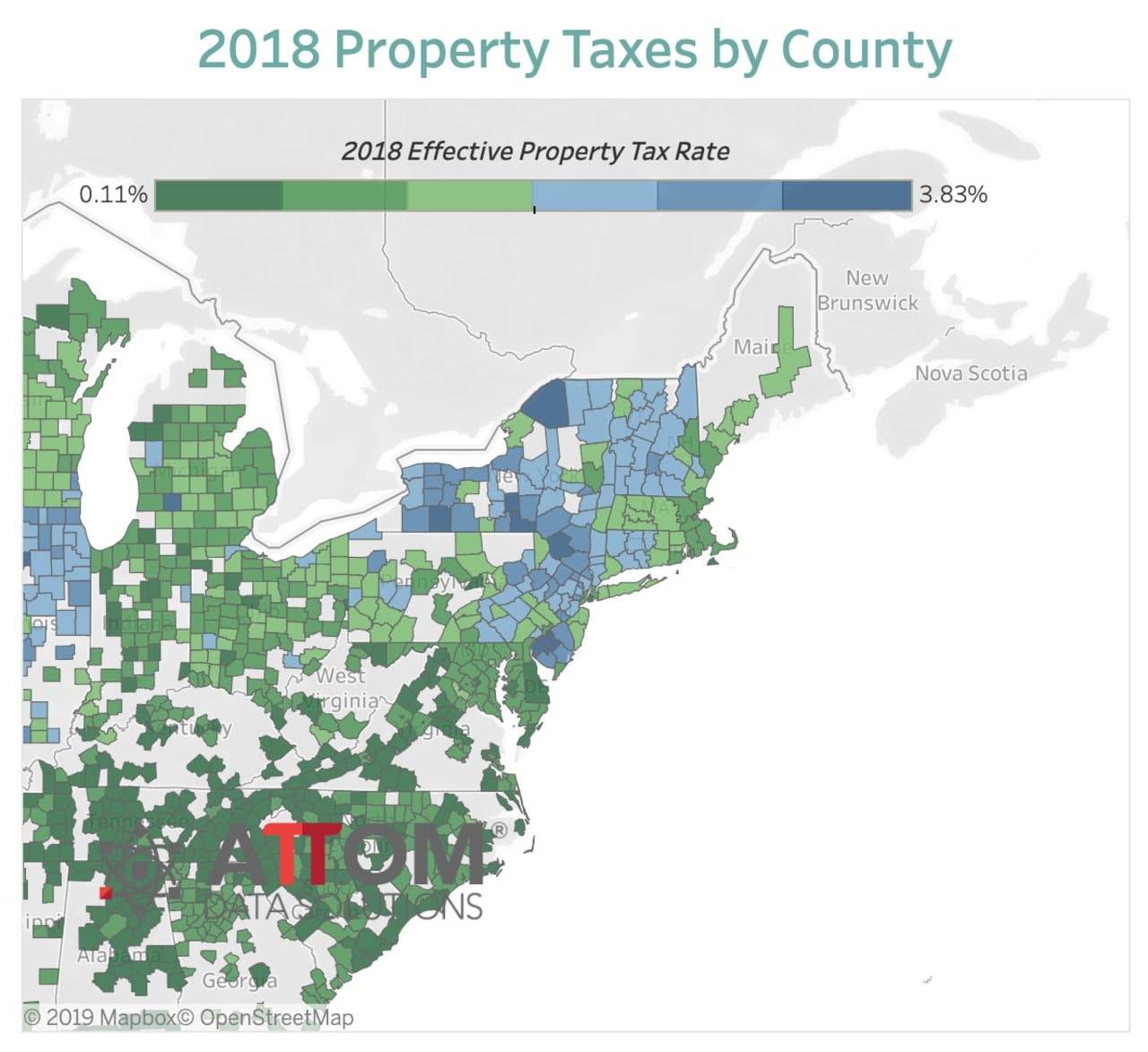

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

North Central Illinois Economic Development Corporation Property Taxes

Putnam Passes 10 Cent Property Tax Increase Ucbj Upper Cumberland Business Journal

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Property Taxes Are Getting Higher Out Of Alignment

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

914 346 6467 Landscaping Westchester Ny Commercial Landscaping Landscape Amazing Landscaping Ideas

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

New York Property Tax Calculator Smartasset

August 2020 Snapshots Real Estate Inventory

Property Taxes Are Getting Higher Out Of Alignment

New York City Property Tax Rate Is It Worth Selling

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice

Farmland Assessments Tax Bills Purdue Agricultural Economics